Overview of PNC’s Dividend Performance

As a financial journalist based in New York City’s Financial District, I often find myself examining the dividend performance of major financial institutions like The PNC Financial Services Group, Inc. PNC, a diversified financial services company operating primarily in the United States, has been a consistent dividend payer, with its annual dividend per share amounting to $6.40. This translates into a dividend yield that has been reported around 3.64% to as high as 4.3% depending on the market conditions.

Dividend Growth and Stability

PNC’s ability to consistently increase dividends over the years is impressive. For instance, the company has raised its dividends for 15 consecutive years, reflecting its financial stability and capacity to maintain consistent payouts. The dividend yield is a key metric for investors seeking regular income from their investments, especially in a sector as volatile as banking.

Payout Ratio and Financial Allocation

The payout ratio, which indicates what percentage of earnings are distributed as dividends, stood at 49.06% for PNC. This suggests that the company allocates nearly half of its earnings to dividends, leaving significant room for reinvestment in growth initiatives or other strategic purposes.

2024 Financial Performance

In 2024, PNC reported a full-year net income of $6.0 billion, with $13.74 in diluted earnings per share. This performance is notable as it indicates solid financial health, which supports the sustainability of dividend payments. Additionally, PNC’s fourth-quarter 2024 net income more than doubled compared to the previous year, reaching $1.63 billion. This strong financial performance helps maintain investor confidence in the company’s ability to continue paying dividends.

Quarterly Dividend Payments

PNC pays dividends quarterly, which provides shareholders with a predictable stream of income. The last ex-dividend date was January 15, 2025, with a payment of $1.60 per share. While the next dividend is anticipated to be declared soon, the exact amount will depend on the company’s future performance and strategic decisions.

Investment Considerations

For investors considering PNC as a potential holder of dividend stock, the company’s consistent dividend increases and strong financials make it an attractive option. However, market dynamics and future earnings announcements will play crucial roles in determining the actual dividend amounts and yield.

Overall, PNC’s dividend strategy reflects its emphasis on shareholder returns while maintaining a healthy balance sheet for future growth. With analysts generally holding a positive view on PNC’s stock, citing a ‘Moderate Buy’ consensus, investors may view PNC’s dividend profile as a stable component of their investment portfolios.

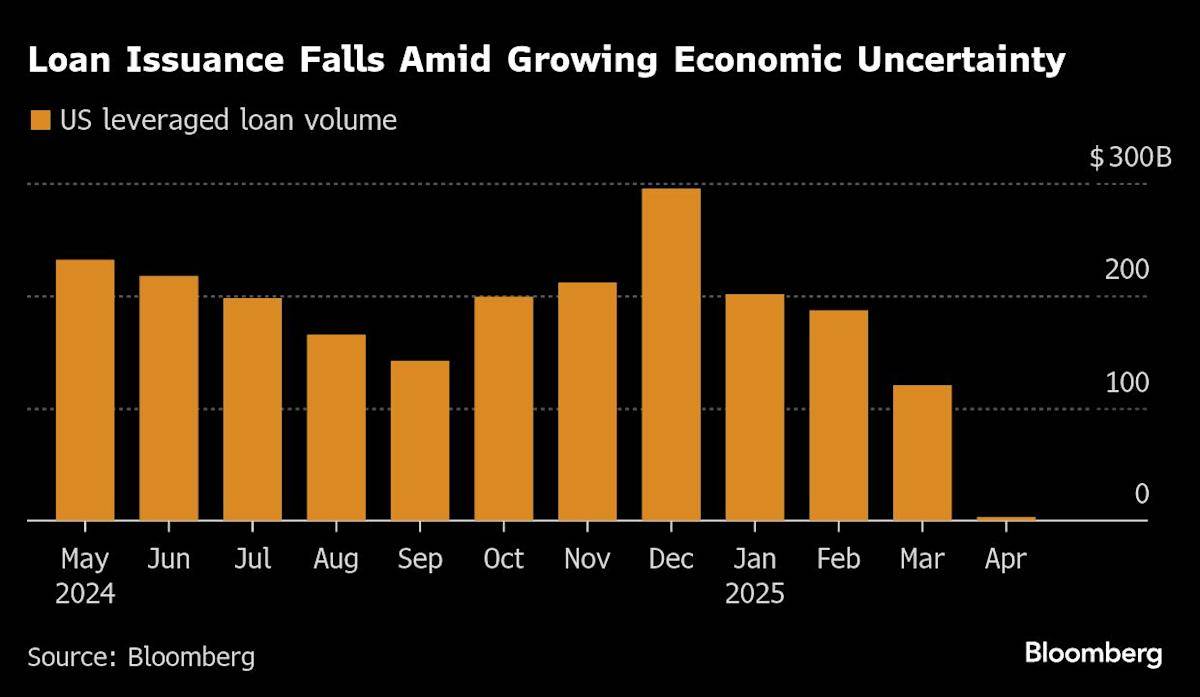

Market Trends and Business Resilience

In the context of market trends, investors should also consider PNC’s overall business performance and market conditions. For instance, in a year where PNC reported a slight increase in revenue and significant growth in earnings, the resilience of its financial services helped it maintain investor confidence. This resilience, combined with a history of dividend growth, positions PNC well for continued interest from dividend-focused investors.

Looking Ahead

As financial analysts continue to assess PNC’s future potential, the company’s ability to manage challenges such as changes in net interest income and broader economic shifts will be critical. Despite a forecasted decrease in net interest income for the first quarter of 2025, the consensus among analysts remains optimistic, with many expecting further earnings growth. This backdrop suggests that while the market may experience fluctuations, PNC’s dividend profile remains a highlight for investors seeking stable returns.

Conclusion

In conclusion, PNC’s dividend stock presents a compelling option for those seeking consistent income with a reputable financial institution. Its strong financials, coupled with a history of dividend increases, make it a solid consideration in the diversified financial services sector. However, it’s essential for investors to monitor market conditions and any shifts in PNC’s financial performance to ensure that this investment aligns with their long-term strategies.

For further updates on PNC and other financial news, consider checking our business section at Epochedge Business.