In recent years, global financial markets have experienced significant turbulence, notably highlighted by the stock market crash in August 2024. This event triggered widespread recession fears and had profound impacts on various sectors, from equities and forex to commodities. To understand the complexities behind such market downturns, it’s essential to dissect the contributing factors, including economic indicators, policy changes, and geopolitical tensions.

One key factor that led to the August 2024 crash was the concerning economic data from the U.S. A weak July jobs report revealed that non-farm payrolls increased by just 114,000, significantly below expectations and a decrease from June’s revised figures. This sluggish job growth, combined with a rising unemployment rate, signaled potential economic trouble ahead. The U.S. unemployment rate climbed to 4.3%, its highest since October 2021, exacerbating fears of a recession.

Another significant factor was the Bank of Japan’s unexpected interest rate hike. The bank increased rates by 15 basis points, moving from nearly zero to 0.25%. This decision disrupted the yen “carry trade,” a strategy where investors borrow at low-interest rates in Japan to invest in higher-yielding assets abroad. The rate hike strengthened the yen and led to a sell-off as traders faced margin calls, further amplifying market volatility.

The crash also highlighted the interconnectedness of global markets. The downturn in stock indices resonated across the globe, influencing forex and commodities markets. For instance, cryptocurrencies like Bitcoin and Ethereum faced heavy losses as investors sought liquidity in an uncertain environment. Similarly, oil shares struggled due to demand uncertainty and geopolitical tensions in the Middle East.

In the broader economic context, rising interest rates and inflation concerns have been persistent challenges. Central banks, including the Federal Reserve, have raised interest rates to combat inflation. Higher rates increase borrowing costs for businesses and consumers, which can reduce spending and investment, ultimately affecting corporate earnings and stock prices. For example, the Federal Reserve increased rates by 0.75% over the past year, reflecting its aggressive stance against inflation.

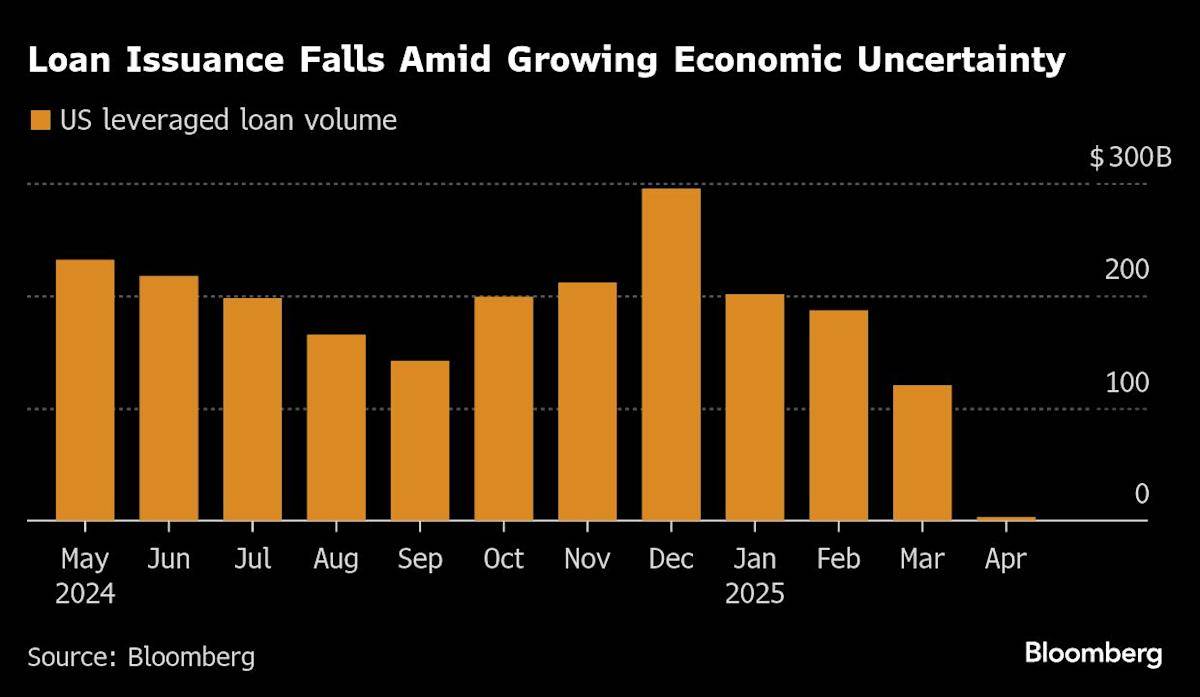

Furthermore, geopolitical tensions and trade disputes have played a role in recent market volatility. In early 2025, concerns over a trade war involving the U.S., China, and Canada led to a sharp decline in the U.S. tech sector. The tech-heavy Nasdaq index experienced its largest single-day loss since 2022, wiping out over $1 trillion in market valuation as investors became increasingly cautious about the potential impact of tariffs on profit margins.

Looking forward, the path to market recovery depends on addressing these economic challenges and achieving greater clarity in policy decisions. As Dilin Wu, a research strategist at Pepperstone Australia, noted, a sustained recovery requires signs that inflation and recession risks are easing. Until then, investors may continue to favor defensive investments over high-risk stocks.

Overall, understanding the intricate web of economic indicators, policy shifts, and geopolitical factors is crucial for navigating the complexities of market dynamics. As ongoing economic challenges persist, investors and policymakers alike must remain vigilant to the potential triggers of future market instability.