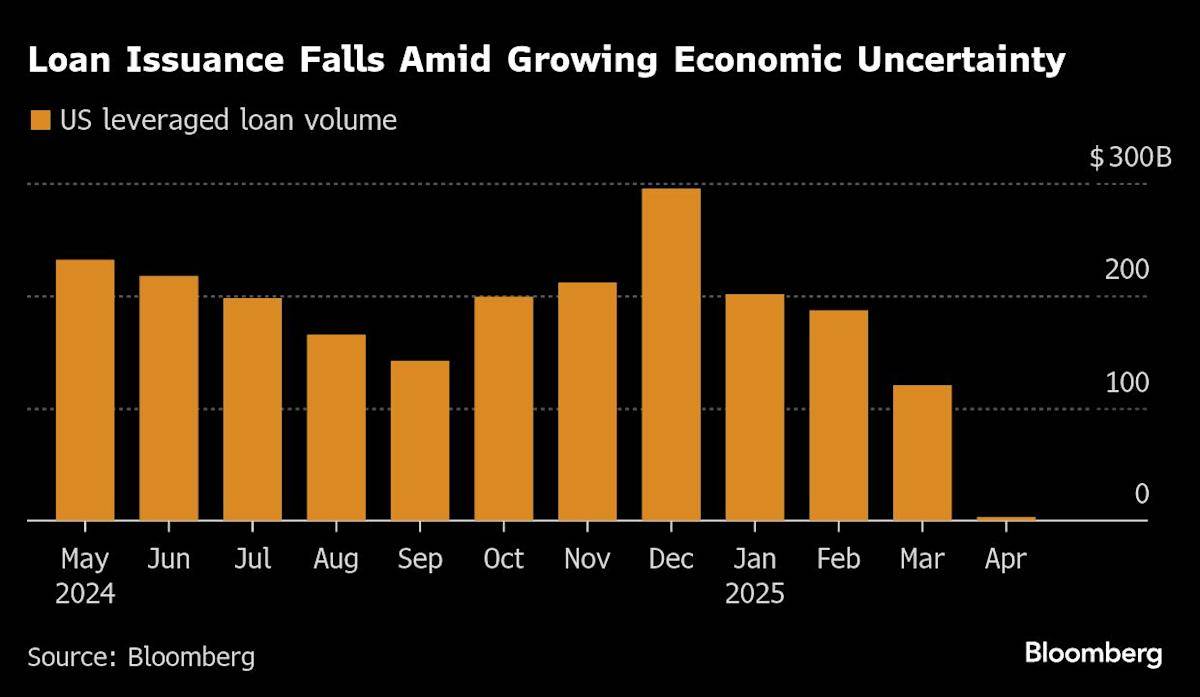

Tariffs have become a significant tool in global economic policy, affecting various sectors and financial markets. Recently, their impact on leveraged finance markets has grown, as they increase debt deal risks. Leveraged finance, which involves borrowing by companies with sub-investment-grade credit ratings, is crucial for transactions like leveraged buyouts and mergers and acquisitions.

Leveraged finance focuses on providing capital to companies that are not highly rated by credit agencies. These companies often use debt to fund large transactions, such as acquiring other businesses or expanding operations. The structure of these deals involves syndicating loans or underwriting high-yield bonds, which offer higher returns to compensate for the higher risk involved. Clients in this sector are typically riskier firms or private equity companies, rather than sovereign entities or blue-chip corporations.

Tariffs can add complexity to leveraged finance transactions by increasing costs and uncertainties for companies. When tariffs are imposed, they can raise the expenses of raw materials or finished goods for businesses, potentially affecting their ability to repay debts. This escalated risk may lead to higher interest rates on leveraged loans or bonds, as investors seek greater compensation for the increased uncertainty.

For example, sectors like autos, retail, and technology are particularly sensitive to tariff changes. Companies in these sectors might see their profit margins squeezed as they face higher input costs from tariffs. To maintain profitability, they might either absorb these costs, reducing their profit margins, or pass them on to consumers, potentially slowing economic growth.

The imposition of tariffs often leads to a defensive market stance, with investors favoring safer assets like US Treasuries and safe-haven currencies. This trend can further raise concerns about corporate debt sustainability, especially in the leveraged finance space, where companies may struggle to service their debt if tariffs persist.

Going forward, the duration and scope of tariffs will be crucial. If tariffs remain in place for an extended period, they could lead to more permanent supply chain shifts, affecting how companies operate and manage their finances. Legal challenges to tariffs may also introduce additional volatility, as countries may retaliate with their own trade restrictions, further entangling global markets.

In response, investors and companies alike are seeking strategies to mitigate the risks associated with leveraged finance in a tariff-heavy environment. This includes diversifying portfolios and closely monitoring the impact of tariffs on specific sectors and economies. As the situation unfolds, it’s clear that tariffs will remain a significant factor in shaping the landscape of leveraged finance and broader economic trends.