As President Donald Trump recently announced a 10% global tariff on all imports entering the U.S., the stock market responded with significant declines. This move aims to bolster the American manufacturing sector by imposing a broad trade measure under the International Emergency Economic Powers Act (IEEPA)[1][2]. The tariff, set to take effect on April 5, 2025, follows a series of previous trade actions, including increases on imports from Canada, Mexico, and other countries[3][4].

Market Impact

On the day after Trump announced the global tariff, U.S. stock markets experienced a substantial sell-off. The Dow Jones Industrial Average and the S&P 500 dropped by about 3.98% and 4.84%, respectively, while the Nasdaq Composite fell by 5.97%[1]. These significant losses affected various sectors, including tech giants like NVIDIA, Apple, and Microsoft, as well as major retailers such as Dollar Tree, Nike, and Target[1].

Economic Context and Response

The tariff announcement comes amidst a mixed economic backdrop. Despite positive job market news—228,000 jobs added in March, exceeding expectations—the economic uncertainty exacerbated by the tariffs has overshadowed positive indicators[1]. The tariffs are part of a broader economic strategy to address perceived trade imbalances, with some countries facing increased reciprocal tariffs if deemed to engage in nonreciprocal trade practices[2].

Global Trade Dynamics

Increased tariffs on goods from certain countries could lead to retaliation and further trade tensions. For example, China has already imposed retaliatory tariffs on U.S. farm products, and the European Union has announced plans to delay but eventually impose its own set of tariffs on U.S. goods in response to American trade actions[3].

Strategic Exemptions and Implications

USMCA-compliant exports from Canada and Mexico are exempt from the new tariffs, but imports that do not qualify for duty-free treatment will still face a 25% tariff imposed earlier[2]. These strategic exemptions reflect ongoing efforts to manage trade relations with key partners while pursuing broader economic goals.

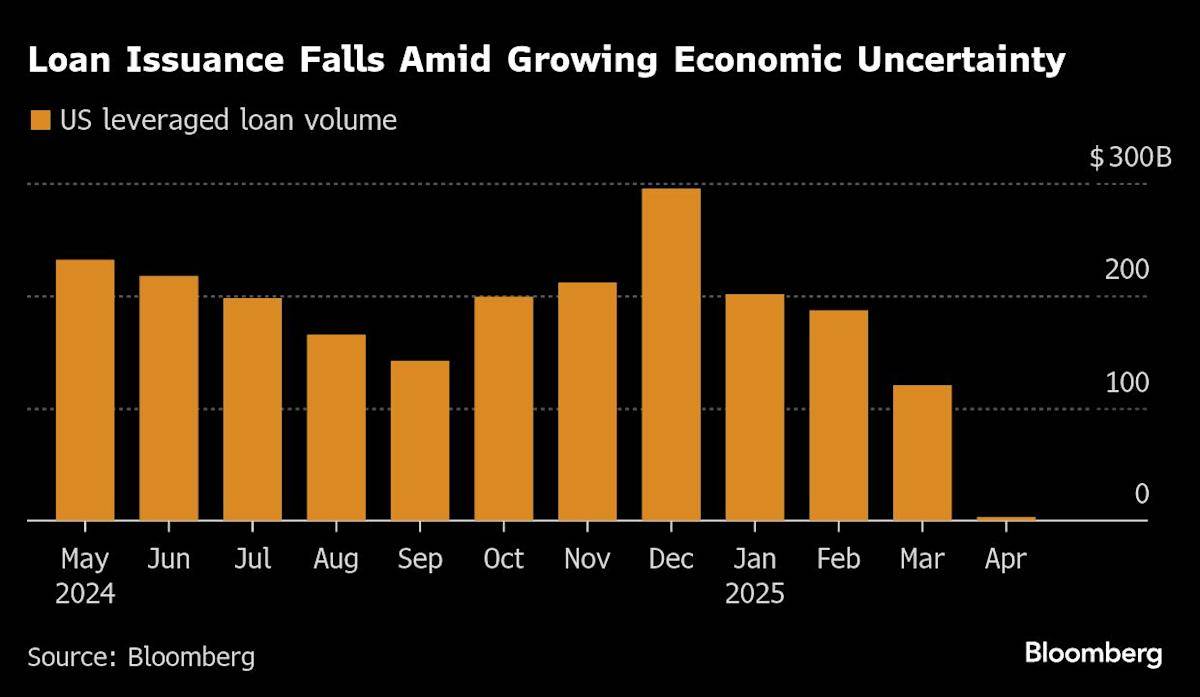

Investor and Economic Outlook

Market analysts are closely watching how these tariffs will affect consumer prices, corporate profitability, and overall economic growth. While some see the tariffs as a means to protect domestic industries, others worry about their impact on inflation and the broader economy. As global trade dynamics continue to evolve, understanding these complex economic shifts is crucial for investors and policymakers alike.

The implementation of these tariffs marks another significant step in Trump’s trade policies, which have been characterized by their aggressive and sometimes unpredictable nature. As we move forward, it will be important to monitor both the direct economic impacts of these measures and the broader geopolitical consequences they may trigger.

For more insights into economic trends and corporate finance, visit Epochedge Business for in-depth analysis and news coverage.