Global Tariff Impact and U.S. Strategy

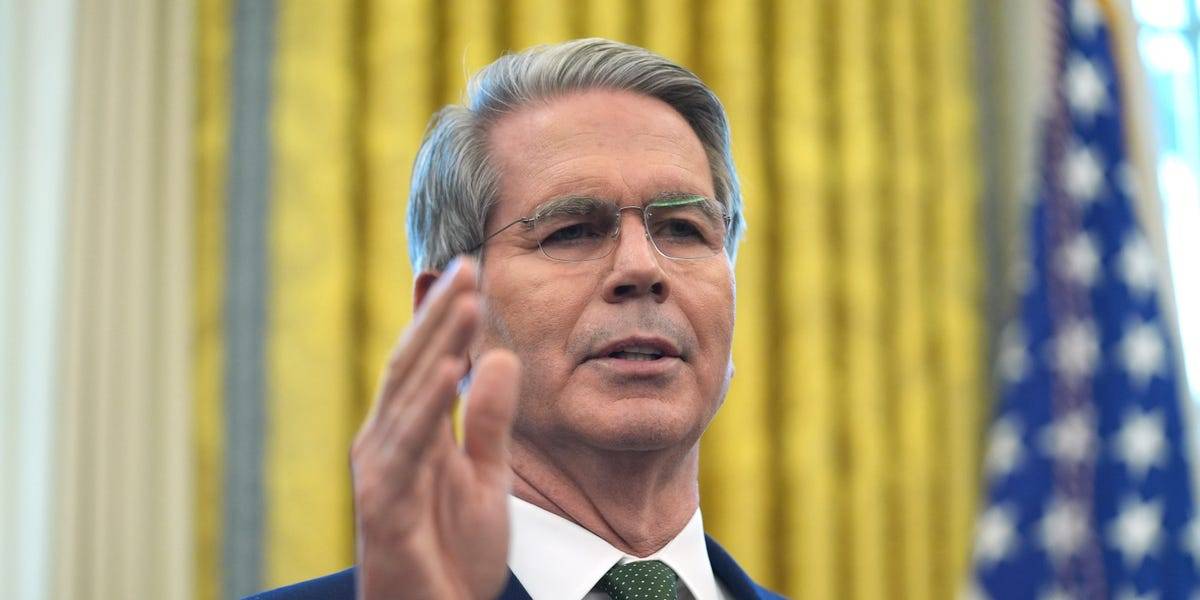

As global economies grapple with the impact of the latest tariffs introduced by the U.S., Treasury Secretary Scott Bessent remains unwavering in his stance that these measures are necessary to address long-standing trade imbalances. Despite a sharp sell-off in financial markets and warnings from economists that the U.S. may slide into a recession this year, Bessent argues that the tariffs will ultimately benefit American industry by encouraging investments and job creation domestically.

Background and Presidential Action

The tariffs are part of a broader strategy outlined by President Donald Trump, who signed a Presidential Memorandum on January 20, 2025, to investigate unfair trade practices contributing to large U.S. trade deficits. The administration believes that non-reciprocal trade arrangements have undermined U.S. manufacturing and critical supply chains, necessitating aggressive action.

Responses from the International Community

Bessent confirmed that over 50 countries have expressed interest in negotiating these tariffs, aiming to reduce or eliminate them. Vietnam, for example, has announced its readiness to negotiate the removal of tariffs on U.S. goods in exchange for easing the high tariffs imposed on its imports. However, Bessent emphasizes that any meaningful negotiations will require time and concrete commitments from these countries to address their non-tariff barriers and currency manipulation practices.

Market Reactions and Economic Outlook

The introduction of these tariffs has led to significant market volatility, with U.S. equities losing $5 trillion in value over two trading days. Economists at JPMorgan have revised their economic outlooks, predicting a recession in the U.S. this year due to the intensified trade tensions. Nonetheless, Bessent maintains that focusing on establishing strong economic foundations for future growth is more critical than fearing a recession.

Impact on American Retirement Savings

In trying to reassure Americans amidst the financial turmoil, Bessent downplayed concerns about retirement savings. He noted that while stock market fluctuations can be alarming, they do not accurately reflect the long-term stability of investments. Most Americans, he suggested, do not have all their savings in the stock market, which traditionally is considered a long-term investment vehicle.

Future of International Trade

The ongoing tariff negotiations and their outcomes will be crucial in determining both U.S. and global economic trajectories in the coming months. As governments and markets respond to these developments, the ability to adapt and find mutual ground will be pivotal in shaping the future of international trade. With the U.S. pushing for reciprocity in trade agreements, other countries must decide whether to comply or risk further escalation in tariffs.

For more insights into economic trends and financial analyses, visit Epochedge Business or explore market news at Epochedge News.