In a remarkable shift for the financial world, U.S. Treasury Secretary Janet Yellen recently acknowledged Bitcoin’s evolving role as a store of value. This represents a dramatic change from her previous stance, where she often highlighted concerns about cryptocurrency risks.

“We’re seeing Bitcoin mature into something beyond mere speculation,” Yellen stated during a financial conference last week. Her comments sent ripples through both traditional finance and crypto markets. Bitcoin prices jumped nearly 5% following her remarks, showing how influential government perspectives remain in this space.

The Treasury Secretary pointed to Bitcoin’s increasing adoption by institutional investors as evidence of its changing status. Major companies like MicroStrategy and Tesla have added Bitcoin to their balance sheets in recent years. These moves suggest Bitcoin might be finding its place alongside traditional assets like gold.

What does “store of value” actually mean? Simply put, it’s something that holds its worth over time without major depreciation. Gold has traditionally filled this role for thousands of years. Now Bitcoin, with its fixed supply of 21 million coins, is being viewed through a similar lens by more mainstream figures.

Some experts believe this shift in tone from Treasury officials signals a broader acceptance. “When top economic authorities acknowledge Bitcoin’s utility, it opens doors for wider institutional adoption,” explains crypto analyst Maria Chen from CoinDesk. The regulatory landscape might also evolve to accommodate this new perspective.

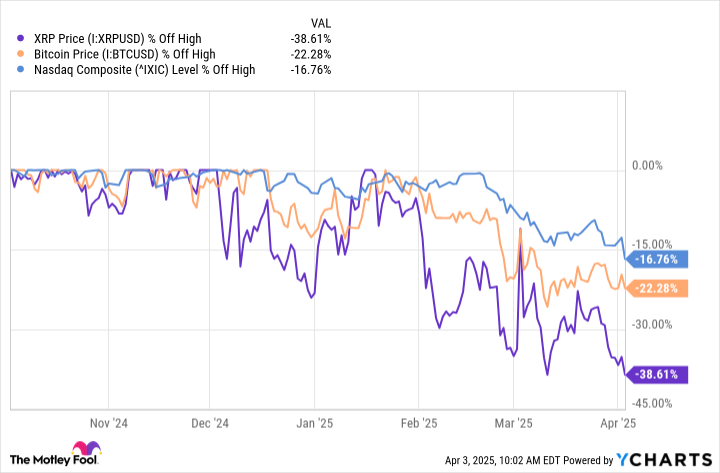

Bitcoin’s journey hasn’t been smooth though. Its value still swings wildly compared to traditional stores of value. Just last year, prices dropped over 60% before recovering. These fluctuations make some financial experts question whether Bitcoin truly meets the stability requirement for a proper value store.

The environmental impact of Bitcoin mining continues to draw criticism as well. The process requires massive energy consumption, with some estimates suggesting Bitcoin mining uses more electricity than entire countries. Yellen acknowledged these concerns in her comments, noting that sustainable mining practices would be essential for Bitcoin’s long-term viability.

Despite these challenges, Bitcoin’s growing acceptance by major financial players suggests something important is happening. Payment processors like PayPal and Visa now offer crypto services. Major banks have started cryptocurrency custody solutions. These developments indicate the technology is becoming more embedded in our financial system.

For everyday people, this evolution might mean more than just investment opportunities. If Bitcoin continues to gain recognition as a legitimate store of value, it could eventually offer an alternative way to preserve wealth during uncertain economic times. This could be especially important in countries experiencing high inflation or currency instability.

The Treasury Secretary emphasized that regulation remains important despite this evolving view. “We must balance innovation with consumer protection,” she noted. This balanced approach suggests government officials are working to understand cryptocurrency rather than simply resist it.

Global perspectives are shifting too. Countries like El Salvador have adopted Bitcoin as legal tender, while others are developing their own digital currencies. These different approaches highlight how nations are responding to the changing financial landscape in various ways.

What happens next depends on many factors. Bitcoin must continue addressing technical challenges around transaction speed and network capacity. Regulatory frameworks need to mature without stifling innovation. And perhaps most importantly, public perception needs to evolve beyond seeing crypto as merely speculative.

For those interested in learning more about Bitcoin’s potential as a store of value, resources like the MIT Technology Review and Bloomberg Crypto offer in-depth analysis. Staying informed through reputable sources helps navigate this complex but fascinating financial evolution.

As we watch this space develop, one thing seems clear: cryptocurrency has moved beyond its early days as a fringe technology. When the Treasury Secretary acknowledges Bitcoin’s potential role alongside traditional assets, it signals a new chapter in our understanding of what money and value might mean in the digital age.